are dental implants tax deductible 2021

You were 18 years of age or older at the end of 2021. Any 7 should be remembered as a good thing.

Your Guide To Dental Insurance In Ontario Guelph Dentist

For example if youre a federal employee participating in the premium conversion plan of the Federal Employee.

. You can deduct 5 of your gross income. Now there are two deduction methods you can employ. Any 7 should be remembered as a good thing.

In all 5 percent of your adjusted gross income. No smiles as dental expenses rejected. Dental implants are tax deductible so thats good news.

Employer-sponsored premiums paid under a premium conversion plan cafeteria plan or any other medical and dental expenses paid by the plan arent deductible unless the premiums are included in box 1 of your Form W-2 Wage and Tax Statement. A good things to remember is that anything 75 of your gross total income is tax deductible. Dental implants are tax deductible so thats good news.

This is only useful to you if your write-offs are greater than the standard deduction. To enter your medical expenses go to FederalDeductions and CreditsMedicalMedical Expenses. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are.

If you are 65 or over they are deductible to the extent they exceed 75 Please click here for more information. You made a claim for medical expenses on line 33200 of your tax return Step 5 Federal tax or for the disability supports deduction on line 21500 of your tax return. To put it another way an AGI of 50000 could allow you to deduct expenses over 3750 50000 x 4 in general.

Dental implants are tax deductible so thats good news. The good news is yes dental implants are tax deductible. 22 2022 Published 512 am.

Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are applicable to the city of Buffalo in the state of New York. In turn this will reduce your overall taxes increase your refund and decrease the taxes you owe. Single 12200 1650 65 or older.

Are there services covered before you meet your deductible. March 26 2021 3 Min Read. For instance if you had 3000 in dental expenses and made 20000 1500 of your expenses are deductible.

Yes dental implants are an approved medical expense that can be deducted on your return. 1000-3000 Core 250-500 Adv Generally you must pay all of the costs from providers up to the deductible amount before this plan begins to pay. The good news is yes dental implants are tax deductible.

Lets look at what can and cannot be claimed on your tax return as well as how to claim these expenses. We offer payroll tax deductions program that can help you. The Australian Taxation Office ATO has published some of the most unusual claims that they disallowed last financial year.

Buffalo 2021 Payroll Tax - 2021 New York State Payroll Taxes. The second factor involves your adjusted gross income. Any 7 should be remembered as a good thing.

Additionally you should anticipate some new deductions on your taxes for 2021. The deduction is not automatically deducted however so you will need to itemize your deductions in order to claim it. You must also meet the criteria related to income.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500. No services are subject to. The Medical Expense Tax Credit METC is a non-refundable tax credit that you can use to reduce the tax that you paid or may have to pay.

This is specifically mentioned so that helps if it ever came to an audit. Over seven qualified medical and dental expenses are deductible at 100 by the IRS from your unreimbursed uninsured costs. You can deduct 5 of your gross income.

For those unfamiliar tax deductions are kind of important as they can reduce your Adjusted Gross Income or AGI. Most non-cosmetic dental expenses are tax deductible. Payments of fees to doctors dentists surgeons chiropractors psychiatrists psychologists and nontraditional medical practitioners.

Since the average middle class worker earns about 50000 a year you. Some common expenses for retirees that are tax-deductible include the cost of glasses and vision care hearing aids most dental care programs to. When you itemize the IRS allows you to deduct medical and dental expenses that exceed 75 percent of your adjusted gross income for tax year 2021.

Yes Dental Implants are Tax Deducible. A good things to remember is that anything 75 of your gross total income is tax deductible. It also explains Medical care expenses include payments for the diagnosis cure mitigation treatment or prevention of.

Per the IRS Deductible medical expenses may include but arent limited to the following. You were resident in Canada throughout 2021. Medical expenses are an itemized deduction on Schedule A and are deductible to the extent they exceed 10 of your adjusted gross income AGI.

If youre wondering whether cosmetic surgery dental implants LASIK or other medical expenses are tax deductible the IRS has a document for you. You can deduct 5 of your gross income. However to deduct medical expenses it will mean itemizing your deductions.

Since the average middle class worker earns about 50000 a year you. Of course your medical expenses plus your other itemized deductions still have to exceed your standard deduction before you will see a difference in your tax due or refund. Nearly 700000 taxpayers claimed almost 2 billion of other expenses including non-allowable items such as dental costs child care and even Lego sets.

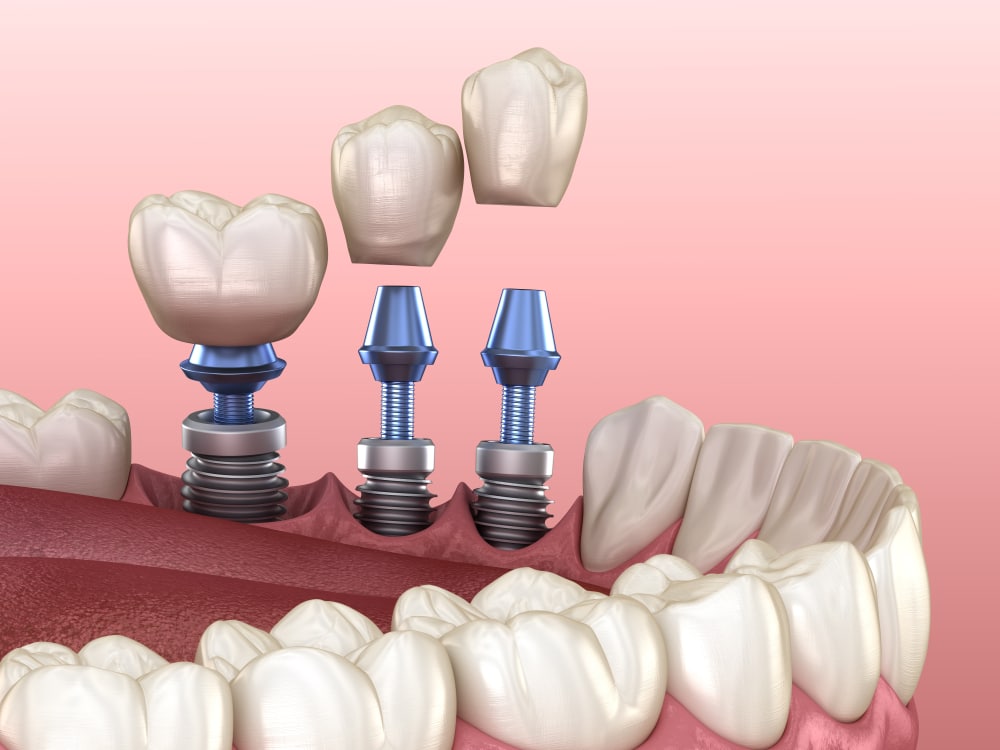

Dental implants count because they affect the structure and function of your body. The deduction is not automatically deducted however so you will need to itemize your deductions in order to claim it. The deduction is not automatically deducted however so you will need to itemize your deductions in order to claim it.

Are Dental Implants Tax Deductible Drake Wallace Dentistry

Dental Implants Surgery In Ottawa Argyle Associates

Are Dental Implants Tax Deductible Quora

How Much Do Dental Implants Cost In Canada Explained Groupenroll Ca

Dental Implant Cost Dental Implants Start From 900

3 Common Ways Insurance Companies Deny Dental Claims Dentistry Iq

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

Dentrix Tip Tuesdays Entering Deductibles Met Benefits Used Dental Insurance Dental Insurance Plans Dental Assistant Study

12 Easy Ways To Get Affordable Dental Implants In 2022 Authority Dental

100 Tax Deductible Dentistry Trusted Advisor

How Much Do Dental Implants Cost In Canada Explained Groupenroll Ca

Are Dental Costs Tax Deductible In Canada Cubetoronto Com

Dentrix Automatically Tracks Benefits Used And Deductibles Met For Patients When You Post An Insurance Pay Term Life Life Insurance Policy Insurance Deductible

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

How Much Do Dental Implants Cost In Canada Explained Groupenroll Ca

What Happens When You Can T Afford Dental Care Wdg Public Health

Dental Insurance Coverage And Cost Forbes Advisor

Dentrix Automatically Tracks Benefits Used And Deductibles Met For Patients When You Post An Insurance Pay Term Life Life Insurance Policy Insurance Deductible