concord ca sales tax rate 2020

For tax rates in other cities see California sales taxes by city and county. You can print a 7 sales tax table here.

Compton CA Sales Tax Rate.

. The California sales tax rate is currently. For tax rates in other cities see Arkansas sales taxes by city and county. City of Concord 975 City of El Cerrito 1025 City of Hercules 925 City of Martinez 975 Town of Moraga 975 City of Orinda.

The 55 sales tax rate in Concord consists of 55 Nebraska state sales tax. California City and County Sales and Use Tax Rates Rates Effective 01012020 through 03312020. The County sales tax rate is.

Corning CA Sales Tax Rate. 1788 rows California City County Sales Use Tax Rates effective April 1 2022 These. Corona CA Sales Tax Rate.

Concord Measure V was on the ballot as a referral in Concord on November 3 2020. For tax rates in other cities see Nebraska sales taxes by city and county. Concow CA Sales Tax Rate.

Concord Measure V was on the ballot as a referral in Concord on November 3 2020. The California sales tax rate is currently. SALES AND USE TAX RATES CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION California Sales and Use Tax Rates by County and City Operative April 1 2022 includes state county local and district taxes.

The California sales tax rate is currently. The Concord Massachusetts sales tax rate of 625 applies in the zip code 01742. Ad Save time and increase accuracy over manual or disparate tax compliance systems.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Concord California is. You can print a 55 sales tax table here.

You can print a 975 sales tax table here. The County sales tax rate is. It was approved.

A City county and municipal rates vary. There is no applicable county tax city tax or special tax. The Compton sales tax rate is.

Remember that zip code boundaries dont always match up with political boundaries like Concord or Middlesex County so you shouldnt always rely on something as imprecise as zip codes to. To review the rules in Massachusetts visit our state-by-state guide. The 975 sales tax rate in Concord consists of 6 California state sales tax 025 Contra Costa County sales tax 1 Concord tax and 25 Special tax.

The 2018 United States Supreme Court decision in South Dakota v. What is the sales tax for Concord California. CA Sales Tax Rate.

There are approximately 15042 people living in the Concord area. The minimum combined 2022 sales tax rate for Colton California is. Concord Measure V was on the ballot as a referral in Concord on November 3 2020.

Wayfair Inc affect Massachusetts. What is the sales tax in Concord CA. The Concord California sales tax is 875 consisting of 600 California state sales tax and 275 Concord local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc.

Copperopolis CA Sales Tax Rate. You can print a 9125 sales tax table here. Did South Dakota v.

These rates are weighted by population to compute an average local tax rate. This is the total of state county and city sales tax rates. The Concord sales tax rate is.

Corcoran CA Sales Tax Rate. Next to city indicates incorporated city City Rate County Acampo. The Concord sales tax rate is.

The current total local sales tax rate in Concord GA is 7000. The state sales tax rate in California is 7250. The 9125 sales tax rate in Concord consists of 65 Arkansas state sales tax 1625 Cleburne County sales tax and 1 Concord tax.

California has recent rate changes Thu Jul 01 2021. The Colton sales tax rate is. California 1 Utah 125 and Virginia 1.

The December 2020 total local sales tax rate was also 7000. The statewide tax rate is 725. Get the benefit of tax research and calculation experts with Avalara AvaTax software.

Cornell CA Sales Tax Rate. Concord CA Sales Tax Rate. State Local Sales Tax Rates As of January 1 2020.

Wayfair Inc affect California. California City and County Sales and Use Tax Rates Rates Effective 01012020 through 03312020. There is no applicable city tax or special tax.

The 975 sales tax rate in Concord consists of 6 California state sales tax 025 Contra Costa County sales tax 1 Concord tax and 25 Special tax. Cool CA Sales Tax Rate. B Three states levy mandatory statewide local add-on sales taxes at the state level.

You can print a 975 sales tax table here. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Compton California is.

What is the sales tax rate in Concord California. The County sales tax rate is. The sales tax jurisdiction name is Dixon which may refer to a local government division.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The December 2020 total local sales tax rate was 8250. There is no applicable city tax or special tax.

There is no applicable special tax. A yes vote supported authorizing an extension and increase to the current sales tax from 05 to 1 generating an estimated 27 million per year for city services including emergency response disaster preparedness local businesses street repair gang. The County sales tax rate is.

The 7 sales tax rate in Concord consists of 4 Georgia state sales tax and 3 Pike County sales tax. Did South Dakota v. Has impacted many state nexus laws and sales tax collection requirements.

The December 2020 total local sales tax rate was 7613.

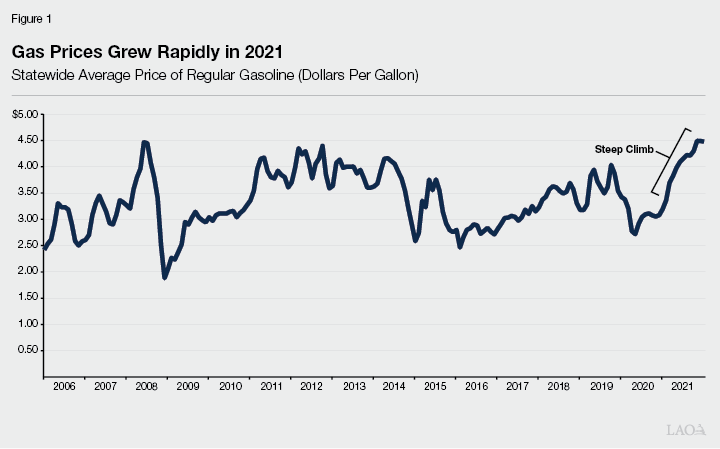

The 2022 23 Budget Fuel Tax Rates

Ontario Property Tax Rates Calculator Wowa Ca

California Sales Tax Rates By City County 2022

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Nc Car Sales Tax Everything You Need To Know

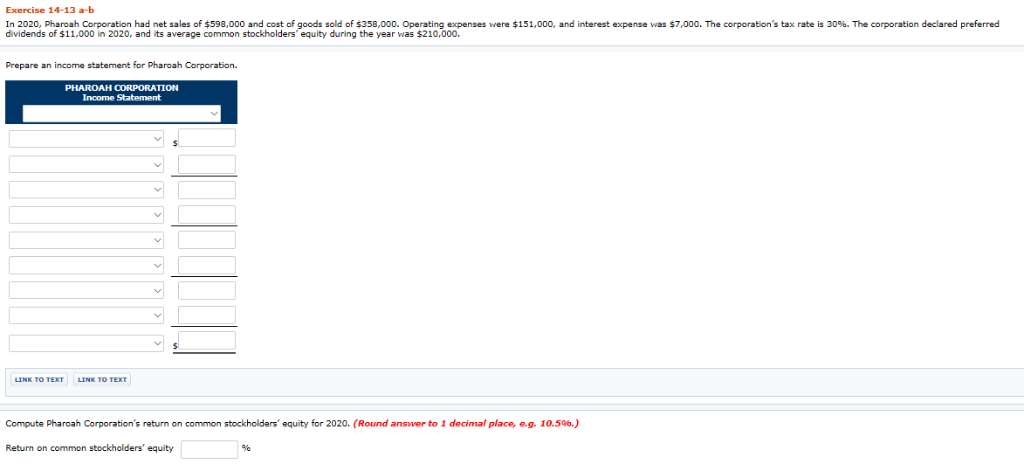

Solved Exercise 14 13 A B In 2020 Pharoah Corporation Had Chegg Com

California Sales Tax Guide And Calculator 2022 Taxjar

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

California Sales Tax Guide And Calculator 2022 Taxjar

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

In States With Property Tax On Cars Do I Also Have To Pay Sales Tax Mansion Global